Valuations Exceed the Average for all Sectors

Summary: The Electrical Wholesaling industry is highly fragmented and set for increased mergers and acquisitions as companies look for continued growth. Companies of all sizes will be potential targets especially those with desirable product lines and advantageous location.

Electrical Wholesaling is an industry that serves the electrical equipment and wiring needs of the industrial, construction, utility and commercial, institutional and governmental (CIG) markets. Primary products categories include general supplies, wire, cable and conduit, communications and security, electrical distribution and controls, lighting and sustainability, automation, controls and motors.

A large fragmented industry:

The industry is highly fragmented and includes thousands of small regional and locally based, privately owned companies. For example, the top 5 players include Sonepar NA, WESCO, Graybar, Anixter and Rexel NA. Collectively the top 5 are estimated to account for $34B of revenue and 33% of the $104B North American market. Moreover, the top 200 players are estimated to account for $64B and only 61% market share. This leaves hundreds of small and regional companies that account for the remaining 39% share of the market.

Acquisitions as a growth strategy:

Most analysts characterize the industry as in the early stages of consolidation. Electrical Wholesaling magazine maintains a database that includes more than 500 acquisitions since the 1990's. Many companies have used acquisitions as a growth strategy however, 9 of the largest companies have implemented such a strategy on a grand scale and in fact have completed 231 (46%) of these transactions. A closer examination indicates that electrical distributors use acquisitions in their strategic growth strategies in many different ways as follows:

- Establish a geographic presence in an adjacent market: For example, Graybar Electric used this strategy to acquire Cape Electrical in 2016 to add locations along the Mississippi and Ohio river.

- Acquire a multi-branch distributor to expand into a new region: Most recently Mayer Electric expanded from its base in the Southeast/Texas to acquire The Hite Co. in Altoona, PA.

- Use an acquired company as a platform for additional acquisitions: Sonepar started its North American acquisition strategy in 1984. Twenty-three years later the market leader has $9.6B in revenue and 988 locations, most acquired through acquisition. Along the way the company frequently used a hub-and-spoke acquisition strategy as platforms for further expansion in various regions.

- Leverage a sought-after key product line: This issue is quite common with Rockwell Automation distributors. Examples include Rexel's 2016 acquisition of Brohl & Appell and CED's purchase of Tri State Supply.

- Establish or build out a presence in a new product specialty or expertise: A good example is Rexel's 2012 purchase of Munro Distributing because of its expertise in working with ESCOs and expertise in lighting retrofits.

- Increase strength of supplier relationships: Larger distributors have more buying power and options when dealing with manufacturers.

Wide range in valuations:

Valuations used to determine the selling price for such acquisitions can vary widely by industry and within industry segments. The size of the target company being acquired as well as the strategic nature of the acquisition like those listed above can have a significant impact on valuation multiples.

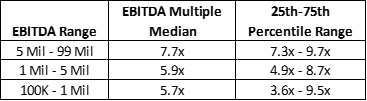

The chart below includes a sampling of electrical wholesaling transactions from companies sold between 1995 to 2018. The data includes an EBITDA range of $100,000 to $99,000,000.

Data: Businesses sold between 1995 and 2018 with revenue between $1 million and $969 million and EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) between $145,000 and $99,329,000. Source Business Valuation Resources Deal Stats database.

Example value calculation using Median Multiple: Electrical wholesaler with $2 Mil of EBITDA may have a value of $11.8 Mil based on the median multiple calculation ($2.0 Mil x 5.9). Actual offers from buyers would be expected to fall within the 25-75 percentile ranges of $9.8 Mil ($2.0 Mil x 4.9) and $17.4 million ($2.0 Mil x 8.7). Higher EBITDA businesses with higher qualitative and strategic factors would be expected to generate the highest offers.

Note: Current PRICE/EBITDA median across all sectors is 4.4 (BVR Deal Stats database)

Growth forecast:

Over the past 50 years average annual growth in the electrical distribution industry was 6%. However, the period of 2008-2017 (since the great recession) industry sales averaged just 1.1% annual growth. Note there was a 2% downturn in 2016, followed by a 6.3% rebound in 2017. Herm Isenstein of Distributor Information Services Corp. (DISC), the electrical industry's leading economist is projecting 2018 growth to come in at 5.8%, with 3.5% growth forecast in 2019 which is then expected to continue into 2020/2021.

Do acquisitions work:

With only 3 public companies operating in the segment, detailed information post acquisition is sometimes difficult to obtain. WESCO is one of those public companies that has actively embraced acquisitions as a part of their growth strategy and has benefited by implementing a highly selective acquisition strategy. Targets must have a strategy consistent with their own, a rate of return greater than WESCO, a projected accretive result in the first year post acquisition and margins higher than WESCO. The company tracks and reports results to shareholders. Those results outline 15 acquisitions since 2010 with a cumulative first year gain in revenue of $2B in 2016. Wesco's experience mirrors BMI' s observations in that acquisitions work when done properly.

Summary: Acquisitions have long been part of the highly fragmented Electrical Wholesale Industry. For the past 20 years the five largest companies have actively and methodically utilized acquisitions to drive a robust growth strategy and now account for roughly one-third of the total North American market. However, independent, family-run businesses still maintain a dominant two-thirds share. That share is expected to slowing decline in the foreseeable future. The combination of persisting fragmentation along with low forecasted industry growth rates signal that "growth by acquisitions" will continue to be a big part of the Electrical Wholesale Industry in the years ahead.

Electrical Wholesale Industry Acquisitions to Continue originated at Business Markets Inc.

completed the exams and requirements for the FINRA series 79 and 63. This brings an additional level of professionalism and protection for his clients and customers. Charles will handle securities transactions as a registered representative of StillPoint Capital, LLC, a FINRA Member firm and registered broker-dealer. Charles spent more than 30 years working with Fortune 200 companies in the high technology electronics industry. He was notably the key contributor that rebuilt and globalized a $1 billion business as well as seamlessly integrating numerous strategic acquisitions for Arrow Electronics. Charles brings a unique set of skills and extensive knowledge of the electronics industry to his clients. He holds a Bachelor of Science in Electrical Engineering from Case Western Reserve University as well as a Master of Science in Computer & Information Science from the University of Pennsylvania. Tom Kerchner, Managing Director of BMI had this to say, "With this accomplishment, Charles helps BMI continue its tradition of exceeding industry norms when it comes to licensing and certifications. This further enhances Charles' credentials as he continues to work with small and mid-size firms in the electronics industry."

completed the exams and requirements for the FINRA series 79 and 63. This brings an additional level of professionalism and protection for his clients and customers. Charles will handle securities transactions as a registered representative of StillPoint Capital, LLC, a FINRA Member firm and registered broker-dealer. Charles spent more than 30 years working with Fortune 200 companies in the high technology electronics industry. He was notably the key contributor that rebuilt and globalized a $1 billion business as well as seamlessly integrating numerous strategic acquisitions for Arrow Electronics. Charles brings a unique set of skills and extensive knowledge of the electronics industry to his clients. He holds a Bachelor of Science in Electrical Engineering from Case Western Reserve University as well as a Master of Science in Computer & Information Science from the University of Pennsylvania. Tom Kerchner, Managing Director of BMI had this to say, "With this accomplishment, Charles helps BMI continue its tradition of exceeding industry norms when it comes to licensing and certifications. This further enhances Charles' credentials as he continues to work with small and mid-size firms in the electronics industry." Data: Businesses sold between 2010 and September 2018 with EBITDA(Earnings before Interest, Taxes, Depreciation and Amortization) between $250,000 and $2,000,000. Source: BVResources Deal Stats database. Example value calculation using Median Multiple: Electrical Contractor with $450,000 of ebitda may have a value of $1.8 million based on the median multiple calculation($450,000 x 4.0). Actual offers from buyers would be expected to fall within the 25-75 percentile ranges or $1.125 million($450,000 x 2.5) and $2.475 million($450,000 x 5.5). Higher EBITDA businesses with high qualitative factors would be expected to generate the highest offers.

Data: Businesses sold between 2010 and September 2018 with EBITDA(Earnings before Interest, Taxes, Depreciation and Amortization) between $250,000 and $2,000,000. Source: BVResources Deal Stats database. Example value calculation using Median Multiple: Electrical Contractor with $450,000 of ebitda may have a value of $1.8 million based on the median multiple calculation($450,000 x 4.0). Actual offers from buyers would be expected to fall within the 25-75 percentile ranges or $1.125 million($450,000 x 2.5) and $2.475 million($450,000 x 5.5). Higher EBITDA businesses with high qualitative factors would be expected to generate the highest offers.